The Underlying Cause Of Major Unemployment And The Federal Deficit So lets do something now that our highly paid and mostly self serving politicians have failed to do. Lets quantify our economic problems, list the causes, list the complications that make solutions more difficult, and then list steps that we can take to correct the mistakes of the past. U.S. Economic Problems: 1. About 30 million unemployed and 30 million underemployed as a result of depressed economic activity in this country. 2. Annual Federal revenue reduced by more than 400 billion dollars. 15 trillion accumulated Federal deficit greater than annual GDP. (Revenue reduction is a larger cause of the deficit than is government spending although government spending is way beyond a sustainable level.) Potential U.S. default and resulting depression and war. (Turmoil in Greece and Italy along with Wall Street/Oakland demonstrations indicate our future.) 3. States struggle with annual revenue reduction of 164 billion dollars. 4. Loosing leading edge capability in high-tech manufacturing - The high-tech balance of trade went negative in 2000. This has significant defense implications. (None of Apple's products are made in U.S. Most are made in China.) 5. Reduced personal wealth that has driven down home prices below mortgage values. 6. We have oversized and overconsolidated financial institutions that are "too large to be allowed to fail. " The greedy and unscrupulous investment houses were allowed to make personal fortunes by betting against investors using depositors money on toxic mortgages and other junk financial instruments and destroyed trillions of dollars in assets that were converted to massive Federal debt. Causes: 1. Fairly consistent 4 year (2005 to 2008) 700 billion dollar annual trade deficits reduced funds available for labor demand within the U.S. economy by about 60 million jobs. This is based upon an average 30% gross margin (70% cost of goods sold), 25% labor content, $40,222 average individual earnings, and a 20X monetary flow multiplier. ((($700,000,000,000 X 70% COGS) X 25%Labor Content) / $40,222 Avg. Wage) X 20 multiplier= 60,900,000 jobs. It seems that everyone neglects the multiplier which has to be included because the entire 700 billion dollars is economic activity outside of the country and provides no flow through in this country. The trade deficit improved in 2009 as the economy deteriorated.

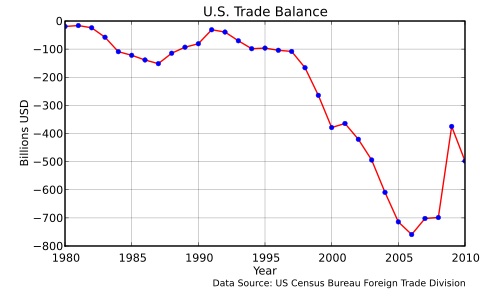

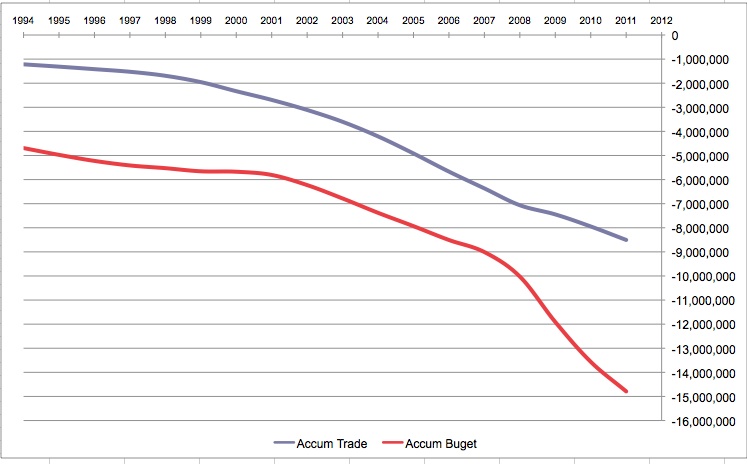

400 billion dollar Federal revenue loss is computed using an effective total Federal tax rate of 16.5%. (60,900,000 jobs X $40,222 avg. wage X 16.5% tax rate = 404 billion dollars in lost Federal revenue. 164 billion dollar State revenue loss is computed using an average State tax rate of 6.7%. (60,900,000 jobs X $40,222 avg. wage X 6.2% tax rate = 164 billion dollars in lost State revenue. The graph below shows the historical relationship between accumulated trade deficits and accumulated Federal budget deficits. The trade deficit is the basis for about 60% of the Federal deficit. For the last several years we have been bleeding out about 5% of our GDP to other nations every year.

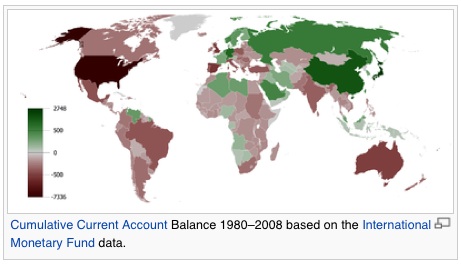

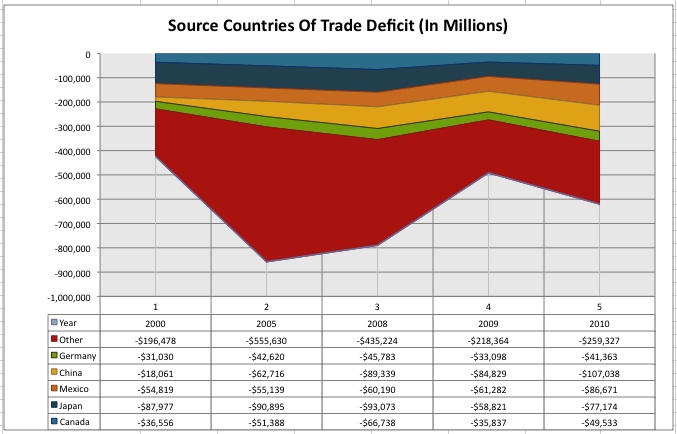

Nations of the world are on the edge of a financial abyss and really don’t know how they got there. Their huge national deficits were only made possible by their huge trade deficits that disconnected them from economic self-sufficiency. The problem is caused by the fact that although capital and commodities can flow from nation to nation, national debt is always stuck within borders. For a while this debt is absorbed by exporting nations until default becomes tangible. Then immediate and brutal and depressing national budget reductions are made which never fix the underlying problem. Greece is on the forefront of this process and the U.S. is really not that far behind. The graph below shows the countries that we have a trade deficit with. The red portion is primarily with countries that we import petroleum from, including Saudi Arabia, Venezuela, Nigeria, Colombia, and Iraq. It is interesting to note that the number one and three countries that we import oil from are Canada and Mexico.

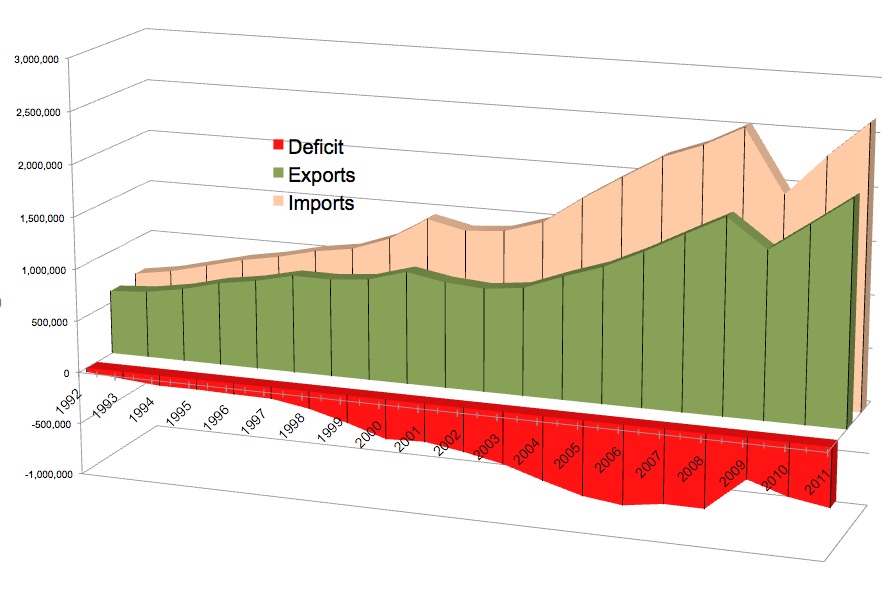

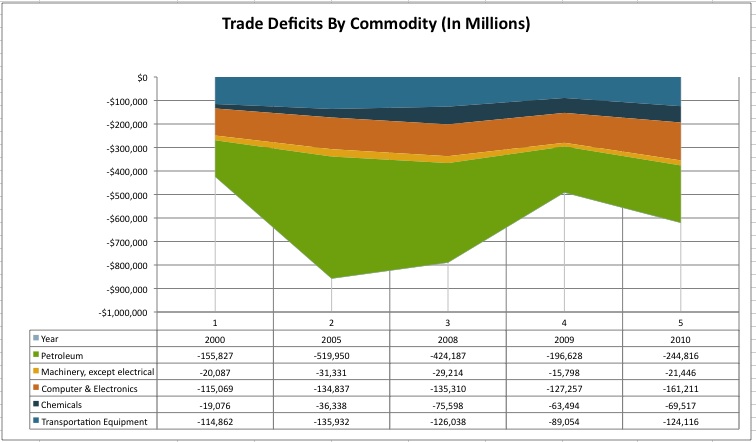

The graph below shows the trade deficit by commodity. We have been importing about three dollars in goods for every two dollars we export.

2. Disgusting lack of leadership from grasping for straws President. Total lack of recognition or prioritizaton by Congress and the liberal news media. 3. Lack of a clear cut policy and priority on energy independence. Petroleum imports are the largest cause of the trade deficit and of the Federal deficit. 4. Multi-national corporations drove passage of GATT, NAFTA, PNTR, and CFTA without any checks and balances for reciprocity. The big fallacy… Poor countries (using nearly slave labor and subsidies) will import more and create more jobs in rich countries. Multi-national corporations take no ownership in the turmoil caused by unemployment. Multi-national corporation chairman Jeff Immelt is now the President’s “Jobs Czar.” This is like having the fox guarding the chicken coop. The greatest danger to our country would be if corporate muscle is so strong that none of our legislators would dare to balance the trade deficit. 5. Federal, State, and local governments mandate a myriad of additional production costs through multilevel taxes, safety and environmental regulations, and minimum wage requirements. However they never mandate where production must be located. They therefore left the door wide open for shelf-price competition to force producers out of the country and avoid these additional costs. 6. Federal policies that fostered very low interest rates and non-existent requirements for large home loans created a financial bubble that hid the underlying reduction in average personal wealth due to depressed economic activity from the trade deficit. Barney Frank and members of the Congressional Black Caucus fought all attempts to provide financial discipline and safeguards within Fannie Mae And Freddie Mac. 7. Repeal of the Glass-Steagall Act in 1999 by bought and paid for Congress and President Clinton allowed huge mergers of banks and investment firms and allowed Federal insured bank deposits to be bet on toxic mortgages and other junk financial instruments. The bubble burst in 2008 and 2009 when declining housing prices forced Fannie Mae and Freddie Mac into default which blew apart the derivatives market which then forced a total financial crisis that was averted only by massively increasing Federal debt. Complications: 1. Because of the depressing load of the trade deficit, we can no longer balance the Federal budget without causing larger deficits, default, and worldwide depression unless we first balance our trade accounts to increase employment and reduce the welfare load. (Again, spending is not the main factor driving the deficit.) 2. We cannot have an effective jobs policy without first balancing our trade accounts. (Without addressing the trade deficit, any jobs policy will be fraudulent smoke and mirrors and we are running out of time and inertia.) 3. Although our dependence upon foreign oil dropped from about 55% to 40% of national consumption, we need to become even more energy independent. 4. About 20% of the trade deficit is from vehicle and vehicle component imports. About 26% of the trade deficit is from electronics imports. By source country, about 12% is from Japan, 17% is from China, 14% is from Mexico, and 8% is from Canada. Click here for a .pdf source file and here for a .pdf analysis file regarding these percentages. 5. The aging of skilled workers is critically reducing our skilled trades capability and our ability to bring back jobs. Many skilled job openings are unfilled today. (We have not had effective skilled trade apprenticeships for over fifty years.) 6. The overly complicated Dodd-Frank Wall Street Reform and Consumer Protection Act did not go far enough in separating the legal activities of banks from investment houses and went too far in regulating every aspect of the financial services industry. This Act appears to have been more of a placebo than a replacement for the Glass-Steagall Act. The financial sector of banks and investment firms have an almost unlimited amount of money to lobby Congress and to affect congressional elections. They will resist any attempt to to strengthen the Dodd-Frank Wall Street Reform and Consumer Protection Act. This means we will eventually have a repeat of the financial crisis of 2008 / 2009 with another round of additional merging of huge financial institutions and huge increases in the Federal deficit that could drive this nation into total default. Solutions: 1. Increase the supply of domestic petroleum and natural gas for the short term and produce Ethanol from natural gas. Eliminate the ethanol from biomass program that consumes about as much energy as it produces while it increases food costs and reduces food exports. 2. Add reciprocity to existing trade treaties and require trade balance using negotiable import trade certificates. (Warren Buffet’s idea.) For example, I export about $50,000 in goods to Canada each year. I should receive a certificate that another company could buy from me that would allow them to import from $75,000 down to $50,000 in goods. This would give small businesses more incentive to spend the time and go through the pain of exporting. More at http://en.wikipedia.org/wiki/Import_Certificates 3. Immediately start supporting four year skilled trades apprenticeships in NDT, welding, tool and die making, machining, electronics, electrical power distribution, pneumatics and hydraulics, machine design, etc. within domestic businesses. Without financial support and some guarantees, businesses are afraid of loosing their investment in trained workers to other companies. 4. Set up a system of virtual micro-business incubators by providing a cadre of trained business facilitator ombudsmen, a database of small rentable facilities, subsidized rents for small facilities, guaranteed collateral loans and receivables insurance, free BWC/OSHA, EPA, FDA consultation, and subsidized export brokers. 5. Strengthen the Dodd-Frank Wall Street Reform and Consumer Protection Act and require a minimum of 10% personal equity on all home mortgages. Both of theses necessary actions will require overcoming huge vested interests that include corrupt investment houses that suck value rather than creating it and racist organizations that believe they are entitled to some sort of compensatory free ride. Otherwise we are doomed to repeat the financial crisis of 2009. 6. Start treating poverty as the inability of the individual to create value for himself and for others rather than as a hopeless condition. Enact legislation and regulations to strengthen the five resources required for every individual to create value: 1. Motivation, 2. Knowledge, 3. Enterprises, 4. Health, and 5. Security. When a significant part of the market basket of purchased goods is provided by other economies without exporting a commensurate value of goods to those economies, we become indebted and poorer. This has been going on for about fifteen years now and the results are most visible in our obscene true unemployment rate and our dangerous Federal deficit. Forget the bogus ideas of redistributing dwindling national wealth, further taxing domestic value creation, or blindly cutting spending to balance the budget. These approaches will result in a cataclysm. We need to tell the apparently clueless Super Commission, Congress, and our grasping for straws President that it is finally time to confront the underlying cause and balance our trade with other economies. Natural economics determines that trade is only free when it is balanced. |