A few months ago I came to the realization that it was very unusual for unemployment to be stuck above 8% after all of the stimulus from trillions of dollars in deficit spending. It seemed that there must be something large and unaccounted for that was depressing economic activity. After spending considerable time assessing the situation, I came to the frightening realization that we are in a new and dangerous era where the stage may be set for the world’s economies to implode into an economic free fall.

I am not a conspiracy theorist. I stood at the window where Lee Harvey Oswald shot President Kennedy. It was an easy shot. I am a registered professional engineer. The World Trade Towers collapsed straight down because of their design. My economic assessment uses documented information from government websites and other sources and contains no hint of a conspiracy. Yet the analysis points to an extremely frightening future where the causes of catastrophe would be economic stupidity, the lack of political courage, and the failure of the media to exercise due diligence.

I am not a professional economist but I have taken economics courses at Ohio State for an engineering degree and at the University of Pittsburgh for an M.B.A. I am publishing the attached assessment with the hope that someone smarter than I can show how economic catastrophe will not or cannot happen.

The assessment concludes with logical conjecture as to the economic and sociological outcomes and is meant to initiate concern, dialogue, and hopefully constructive action. If the outcomes seem too alarmist and might incite panic, so be it. Long over due action because of panic is perhaps the only thing that may save us from a terrifying future. Developing this economic assessment has been a very depressing experience because the media and the political candidates keep arguing trivial issues while the ship takes on more water and the band plays on.

A Frightening Economic Assessment ©

"So for all of those who still believe that we can keep on going year after year with a national economy addicted to 1.3 trillion dollars in borrowed stimulus, you had better buckle up because we may be headed into an economic free fall that would bring us into a new dark ages of an existence worse than your worst possible nightmare!"

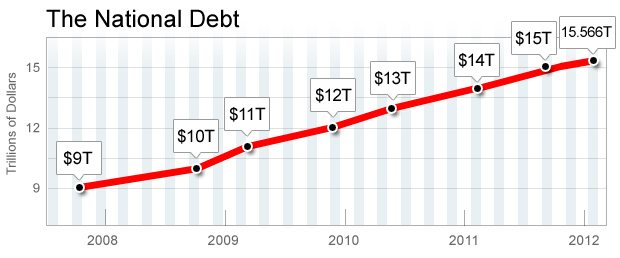

The greatest danger to our nation and to the world is the growing 16 trillion dollar national debt in rolling T-bills, bonds, and notes. The national debt has grown 78% in just four years and is on a fatal trajectory1.

Source: CBS News1

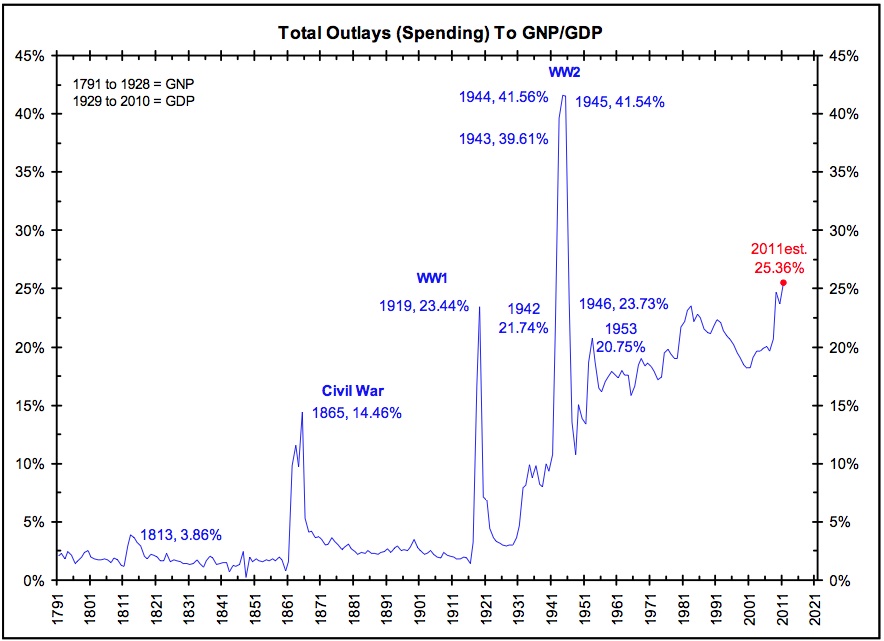

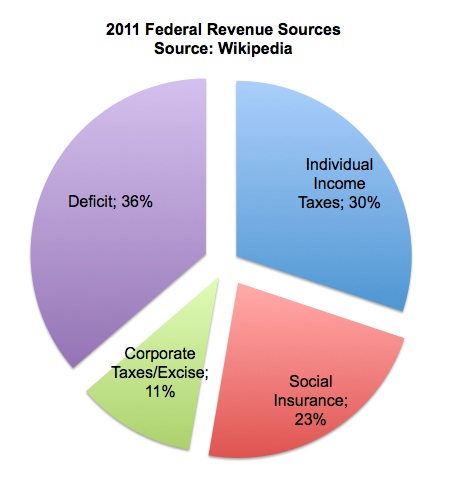

The national debt is far beyond the point of sustainable debt service if the Fed allows interest rates to rise much above the present 1.5% average rate 2. Right now the Fed is using "quantitative easing" which is a politically correct way of saying that the Fed is purchasing much of its own debt at an artificially low interest rate. . During 2011, the Federal Government borrowed 36 cents of every dollar it spent ($1.3 trillion borrowed out of $3.6 trillion in spending 3.) Federal spending accounted for about 25% of GDP in 2011 as shown below4. The Federal spending level has not been this high since World War II. This illustrates how large a burden the Federal Government has become on the general economy. And to this we must also add the burden from State governments.

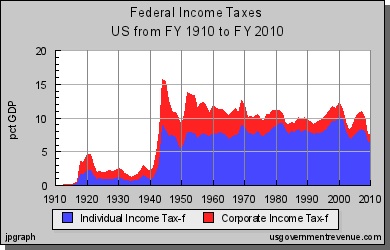

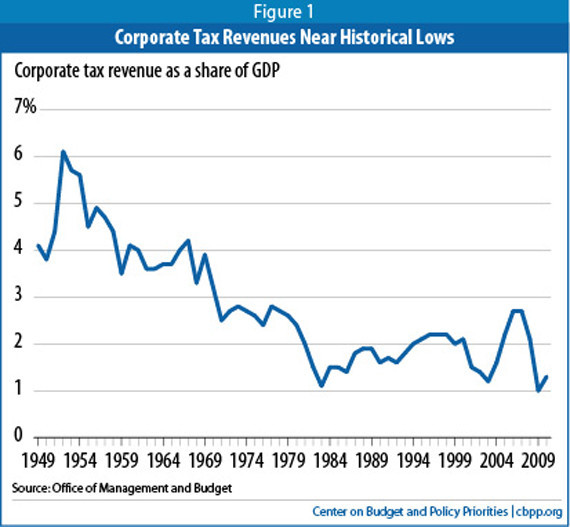

With Federal spending this high and corporate and personal income taxes at a low point, as shown below5, the economy appears to be structured so that Federal deficits will continue to be at very high levels for the foreseeable future.

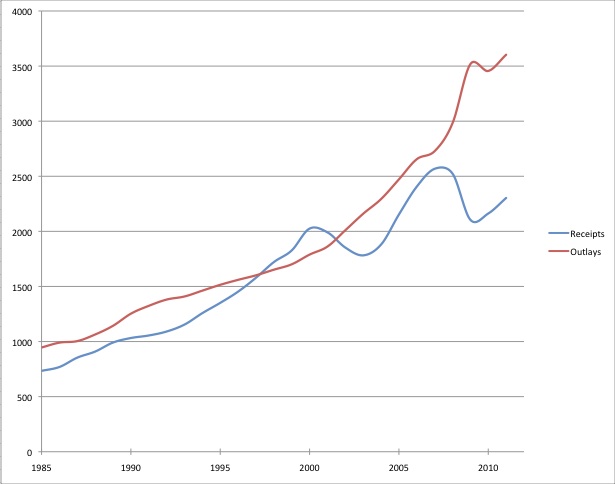

As shown below, Federal Expenditures are now much larger than Federal Receipts. The annual Federal deficit has grown markedly since 2007.

Federal Outlays Versus Receipts In $Billions By Year Source: http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=200

As shown in the diagram below3, about 30% of Federal expenditures were funded by personal income taxes and about 23% were funded by payroll taxes for Social Security and Medicare. About 11% were funded by corporate income taxes, excise taxes, and other charges. With only 64% of Federal expenditures funded by current revenue, the remaining 36% had to be funded by borrowing and expanding currency accounts3. When you think about it, more than one trillion dollars being spent from borrowed money should be one huge economic stimulus and yet we have significant unemployment. This alone indicates that some unrecognized, large, and underlying factor has been depressing economic activity.

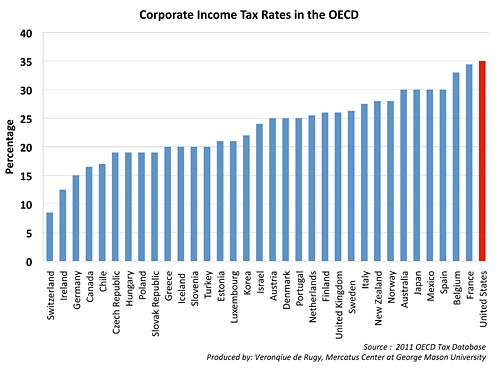

The U.S. Federal corporate tax rate is 35% which is 5% to 25% higher than all competing countries6.

As shown in the chart below, corporate tax revenue has decreased as businesses keep their foreign profits abroad causing a larger Federal revenue dependence on personal income taxes7.

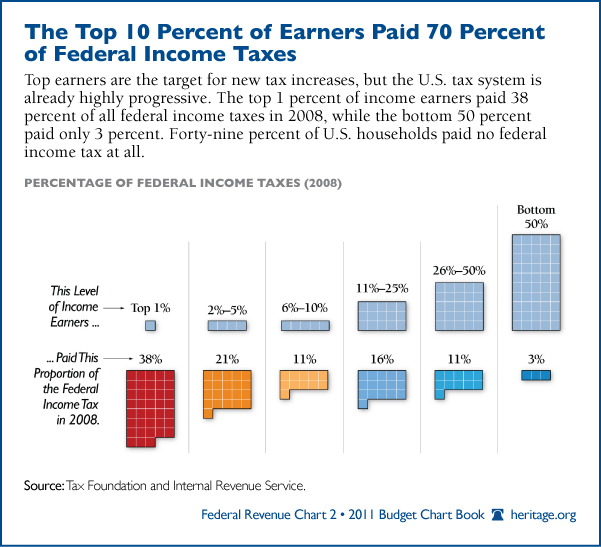

Personal Federal income tax rates are very “progressive.” The top 1% of wage earners contribute 38% of all Federal income taxes and the top 10% contribute 70%8. 47% of all Americans do not pay Federal income tax because of low incomes although they pay into Social Security and Medicare.

The maximum tax rate on the top 10% of wage earners is 35% which generates $646 billion in revenue. An increase of the tax rate to 50% would generate $278 billion more in revenue which amounts to only 21% of the 1.3 trillion 2011 annual deficit. What this all means is that the wage earning tax base has become too small to support Federal expenditures with the decline in corporate income taxes. So, for the President to say that we need a little more tax revenue from the wealthy is based upon his sense of fairness with the decline in “middle class” income and the increase in top wage earner income rather than its real effect on reducing the deficit.

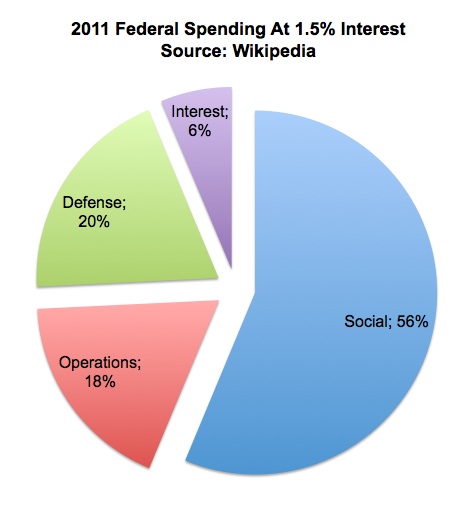

The following graph shows how Federal funds were spent in 20113. Only 6% was spent on interest on the national debt because the effective average interest rate was held at an artificially low 1.5%2. 56% was spent on social entitlements and other mandatory payments that include Social Security, Medicare, and Medicaid. 20% was spent on defense. 18% was spent on discretionary operations spending that included funds to pay for all other government departments.

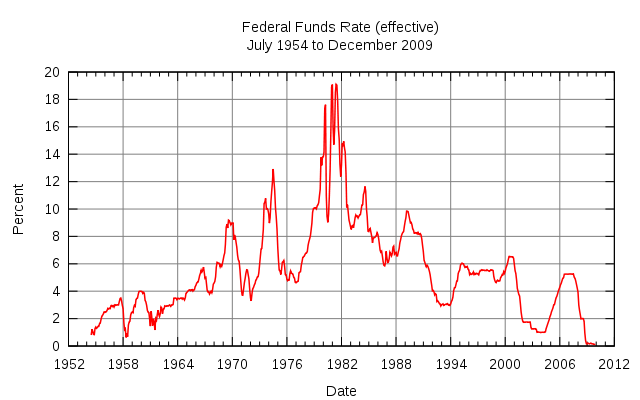

The following graph9 shows that the average effective 1.5% interest rate is well below the historical average of the Federal Funds Rate. The Fed maintains this artificially low interest rate by creating currency accounts and purchasing 61% of the 2011 deficit with the currency it creates. Because the Fed could not attract sufficient investors at 1.5%, it created $830 billion out of thin air to buy its own debt. This trend will only continue with the Fed having to purchase more and more of the annual deficit untill it purchases the entire national debt. Some highly paid bureaucrat thought of the innoquous term "quantitative easing" to discribe this dangerous process. This process will ultimately double M3 or the amount of recognized U.S. currency in deposits and in circulation world wide. Obviously this approach will increasingly devalue the Dollar, reduce purchasing power, and threaten the dollar's acceptance as the world currency. This may lead to hyper-inflation and economic collapse. We will all pay for this deficit financing through higher prices on internationally traded commodities including gasoline. It is not difficult to imagine more and more disposable income being diverted to the cost of energy dispite increasing supplies.

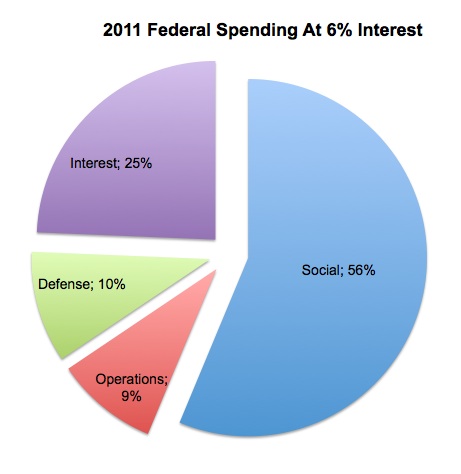

If the average interest rate in 2011 had been allowed to naturally increase to 6%, debt service would have increased to 25% of expenditures and would have crowded out half of both defense and operations spending as shown below. Maintaining the levels of defense and operations spending would have required borrowing 46% of Federal revenue and the annual deficit would have increased from $1.3 trillion to $2.0 trillion.

It can be argued that mandatory social programs have been allowed to grow too large. It can be argued that defense costs are too high because of police actions in Iraq, Afghanistan, and Pakistan. It can be argued that the Federal bureaucracy has grown too large and expensive. These are all causes of increased spending that has contributed to the annual deficits and to the accumulated national debt. The real problem however is that increased spending is not the major cause of deficits and the resulting accumulated national debt!

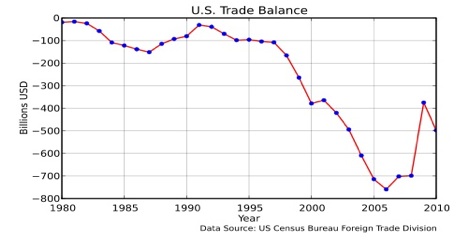

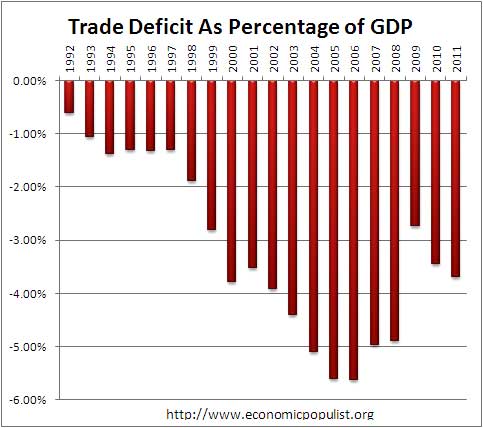

The major underlying cause of the national debt is fourteen years of diminished Federal revenue as a result of increasing annual trade deficits10 11. During a peak four year period, the trade deficit reduced the demand for about 77 million jobs and moved corporate operations and profits offshore. This is what has been depressing the economy in spite of a massive deficit stimulus. This is what has been reducing “middle class” income and shifting it to the upper 10% income earners! This is what has been shrinking Federal and State revenue.

The annual U.S. trade deficit in goods between 2005 and 2008 was more than 700 billion dollars. If 700 billion dollars were spent on additional products manufactured in our economy, it would have required about $500 billion in production costs that would have included at least $125 billion in wages. $125 billion in wages would directly employ 2.9 million wage earners at the 2011 average of $43,46012 each. Based upon the 2011 propensity to save of 3.6%13, the economic multiplier was twenty-seven14. This was due to the extremely low savings and investment rates of our consumer economy that causes a huge multiplier effect on new funds introduced into the economy. These additional 2.9 million wage earners would spend more than 96% of their wages on goods and services that would pass through the economy about twenty-seven times and ultimately drive the demand for about 77 million jobs15. Obviously, any legitimate jobs policy has to start with balancing our trade accounts.

Over the last fourteen years individual economic survival required downshifting into lower skill, lower pay, and low or zero tax bracket jobs and an increase in the cash economy. All of this greatly reduced personal income tax revenues. Other costly adjustments included increased unemployment compensation and food stamp demand. Consequently we have about 30 to 40 million unemployed and 30 to 40 million underemployed. And again, this is in spite of the fact that the Fed is spending $1.3 trillion beyond current revenue. Free trade zealots have argued that higher technology jobs would replace the jobs eliminated by imports. If this were true, the high tech balance of trade16 would not have gone negative starting in 2002.

The Federal Government cannot create private sector jobs with a deficit stimulus! It can only create the demand for them. Part of the trade deficit problem is that without effective measures to assure competitive domestic capacity, stimulated demand for many goods will be transferred to foreign production. Federal, State, County, and local governments mandate multi-levels of taxes and regulations that add cost to domestic manufacturing but they never mandate where goods must be manufactured. They all left the door wide open for shelf price competition to force production abroad. Bleeding up to 5% of GDP into foreign production creates an economic hole that requires massive fiscal deficits at the same time that full employment becomes impossible. Any Federal stimulus will loose effect as it stimulates production in foreign economies. This is the reason that the Obama stimulus had disappointing results and why even a $1.3 trillion annual deficit cannot drive full employment.

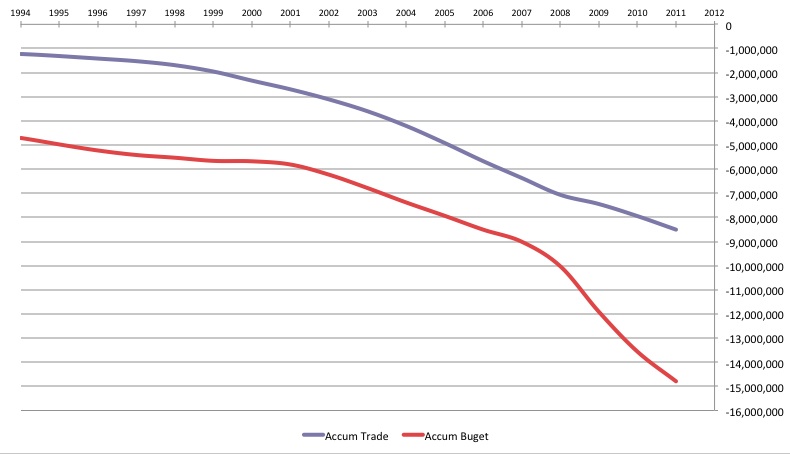

The reduction in taxable wages causes national “reverse tariffs” of more than $530 billion in reduced Federal personal income taxes17, $350 billion in reduced Social Security taxes18, and $50 billion in reduced Medicare taxes19 for a total impact of $930 billion in reduced Federal wage related revenue. Including $219 billion in reduced corporate income taxes20, all this adds up to a $1.1 trillion in a reversed tariff of reduced Federal revenue from a trade deficit of $700 billion. Added to this was the $226 billion reduction in State personal income taxes21 with additional losses of State corporate income taxes. This is why the States are hurting. The total gets amazingly close to the amount of the Federal budget deficit. As shown below, over the last fourteen years, the $7.3 trillion increase in the accumulated trade deficit equals 72% of the $10.1 trillion increase in the national debt. The two are directly related by the effect of reverse tariffs. Huge reverse tariffs that accumulate into dangerous national debt drive home the lesson that tariff free trade can only be free if it is kept in balance!

Accumulated Trade Deficit Versus Accumulated Budget Deficit Source Of Data: U.S. Census Bureau

The remainder of the national debt was caused by the unsustainable spending increases due to the demographic effects on entitlements, the expansion of regulatory bureaucracies, long-term police actions in Iraq, Afghanistan, and Pakistan, and to a lesser extent, Bush’s 2008 TARP funding and Obama’s 2009 stimulus. However, without balancing trade accounts and becoming economically self-sufficient first, any massive spending cuts will absolutely break the economy because of the multiplier. Unfortunately, we have painted ourselves into a corner and have allowed the national debt to account for over $50,000 per citizen or $140,000 per taxpayer22. These dollar amounts are more than the net worth of most U.S. citizens and have the potential of wiping out the economic wellbeing of all U.S. citizens in an economic free fall.

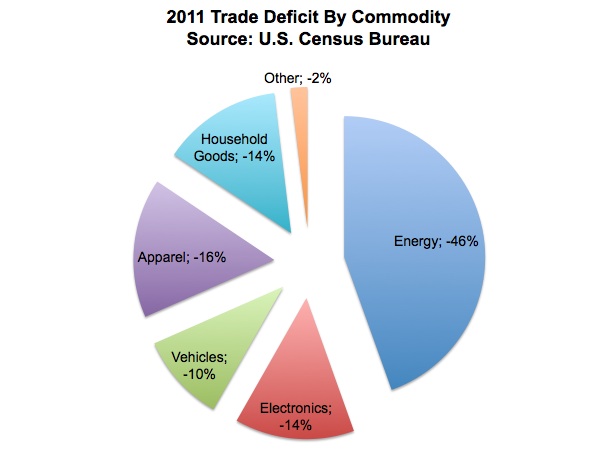

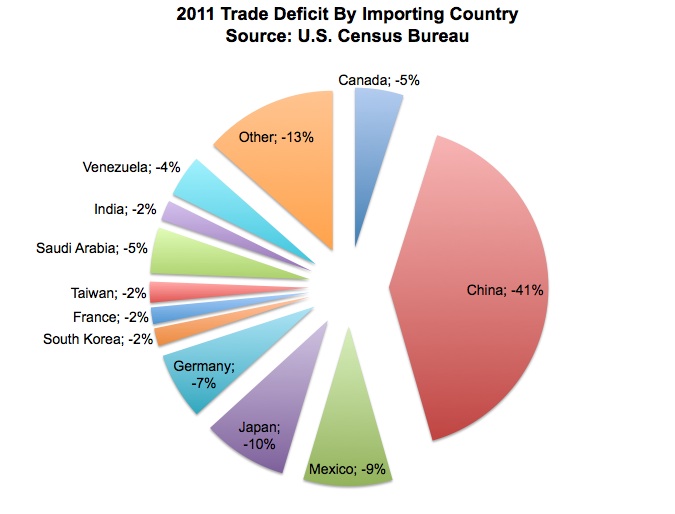

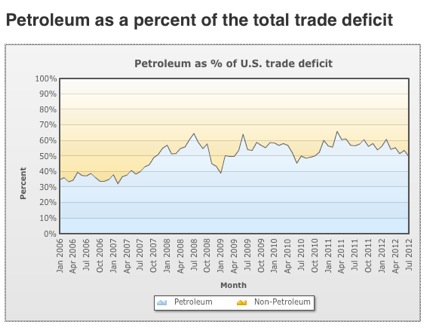

A shown below, 46% of the trade deficit in 2011 was for energy23 and 41% was with China24. Hopefully this 87% of the trade deficit suggests some solutions to balancing trade accounts.

So how do we balance trade without trade tariffs? Here are some suggestions…

In reality, with the national debt now reaching 16 trillion dollars and growing by more than a trillion dollars per year, we may not have enough time to change the deficit trajectory to prevent a worldwide economic free fall. We can thank a number of mistakes that were made over the last twenty years for the extremely dangerous economic situation that we are in:

So, these are most of the mistakes that have put us into deep jeopardy. With competent leadership from the media, the Congress, and/or the President, they were all fixable a few years ago. But our biggest problem now is that no one in leadership is yet talking about our biggest problem and that is the trade deficit. It is imperative to realize now that all of the recent hints of an improving economy are illusions that exist only because of the stimulus of spending an unsustainable and massive 1.3 trillion dollar deficit. Take that deficit financed spending away and the economy will fall like a house of cards.

It may be too late now to bend the trajectory of deficit spending and avoid an economic tsunami. Perhaps the leadership in Washington is now resigned to this and is preparing other measures to control the economy and the population if the economy implodes. Such a policy would be diabolical without communicating any of this to the voters in our democracy.

So for all of those who still believe that we can keep on going year after year with a national economy addicted to 1.3 trillion dollars in borrowed stimulus, you had better buckle up because we may be headed into an economic free fall that will bring us into the new dark ages of an existence worse than your worst possible nightmare!

So, here is how it will probably happen…..

The trigger to catastrophe will be the inevitable default of one or more European governments. The equivalent of several trillion dollars in someone’s assets will evaporate. Part of those evaporating assets will affect holdings in the U.S. via derivatives and will affect the future affordability of any remaining investors who purchase U.S. T-bills, notes, and bonds. Some of the largest banks and investment houses that have not totally dug out yet may be overstressed and freeze liquidity. With more than $18 trillion in national debt by that time, the Fed may no longer be able to finance sufficient funding to unfreeze financial markets as it did in 2009. The evaporation of assets will depress the European economies and our exports to them will decline causing both our trade deficit and unemployment to increase. Federal and State deficits will expand as taxable wages and profits are further reduced even as inflation due to devaluation increases.

The market will panic at the prospect of hyper-inflation. Stock values will sink as investors cash out and put their money into tangibles. A large portion of retirement savings, pensions, and investment income will evaporate. Medicare and Social Security payments will become insufficient. The payroll of Federal and State and local governments will become unsustainable causing large workforce reductions and the levying of heavier regulatory fines to extract the maximum from a dying economy. Housing prices will fall into the basement as bankruptcies and foreclosures mount driving Fannie Mae and Freddie Mack over the brink again. Most credit cards will become unusable and most bank loans will become unavailable. College loans will become extinct and most remaining State support for public universities will be cut further. The auto and housing industries will layoff the majority of their workers as sales plummet and bankruptcies and foreclosures mount. Unemployment will skyrocket. Much farming will be curtailed as seasonal farm loans and subsidies disappear. In one or two seasons the shelves in some supermarkets may become bare. Food will be rationed. An emergency powers act will be instituted to impose martial law in most U.S. cities and civil liberties will be suspended when riots occur and civility disintegrates. All media, cell phone, and internet service will be censored by martial law. Even the survival of the Constitution will be at risk as people look for a “strong leader” who will blame the rich, big business, or other nations and come up with some “common sense” simplistic murderous solutions. At about this time, the world economy will implode into a dreaded deflationary spiral as remaining nonessential consumption is halted until prices bottom. The full economic tsunami will have arrived. Democracies will fall. Armed gangs will maraud. Murdering thugs will climb to power. Wars will occur. The world will become much more desperate and dangerous. The socialists will blame the “rich” capitalists for this failure rather than the unsustainable entitlements that their progressive policies foisted upon national governments. And there will be too many who will never understand the accumulative fatal flaw of free trade without balance.

So in this, perhaps last, election cycle let’s have fun and debate the "really important stuff" like Planned Parenthood and abortion and the "true definition of rape", gay marriage, women’s rights, disclosing only two years of tax returns, true citizenship, locked college transcripts, “big oil”, class warfare, tax breaks for the “rich,” more unfair taxes on the middle class, paying only $1.8 million in taxes on $13 million in investment income, the Hispanic vote, the Black vote, actually requiring a legal I.D. to vote, and of course how big bad business is out to get the middle class. In two years, for the minority who understand the opportunity lost, total misery will make all of these lies and contrived issues seem like a very cruel joke. Most of the ignorant millions who will go hungry will choose not to understand and will start doing very desperate things. To them it will all be a contrived conspiracy by the despicable rich and require stupid vengeance that will kill off most of the remaining value creation. Soon, we will look back at today and wonder how could it have been this good. This Presidential election may only decide who will be in the Whitehouse when the economic roof caves in. We could have a new “Herbert Hoover” or we could have our first dictator. So friends, welcome to our “Brave New World” and the best of luck to you.

References: 2 $227 Billion Interest/ $14,600 Billion Debt = 1.6% Effective Interest Rate On Debt 3 http://en.wikipedia.org/wiki/United_States_federal_budget 4 http://www.ritholtz.com/blog/2011/07/government-spending-as-a-percentage-of-gdp-2/ 5 http://www.usgovernmentrevenue.com/income_tax_history 6 http://mercatus.org/publication/corporate-income-tax-rates-oecd 7 http://www.huffingtonpost.com/2011/03/02/corporate-tax-revenues-ne_n_830361.html 8 http://www.heritage.org/federalbudget/top10-percent-income-earners 9 http://en.wikipedia.org/wiki/Federal_funds_rate 10 http://en.wikipedia.org/wiki/Balance_of_trade 12 http://www.ehow.com/info_7746957_average-annual-salary-america.html 13 http://www.wisegeek.com/what-is-the-average-propensity-to-save.htm# 14 http://www.investopedia.com/terms/m/multiplier.asp#axzz28BIM2GCr (1/.036 propensity to save= economic multiplier of 27.8) 15 2.9 million directly unemployed X 27 multiplier = 77 million total unemployed 17 77 million unemployed X $43,460 avg. wage X avg. 15.74% tax rate = $530 billion reduced income tax revenue. 18 77 million unemployed X $43,460 avg. wage X avg. 10.4% tax rate = $350 billion reduced social security revenue. 19 77 million unemployed X $43,460 avg. wage X avg. 1.45% tax rate = $50 billion reduced Medicare revenue. 20 $14.6 trillion GDP X 1.5% corporate tax reduction = $219 billion in reduced corporate income tax revenue. 21 77 million unemployed X $43,460 avg. wage X avg. 6.7% tax rate = $226 billion reduced State income tax revenue. 22 http://www.usdebtclock.org/ 23 http://www.census.gov/foreign-trade/statistics/product/enduse/exports/c0000.html http://www.census.gov/foreign-trade/statistics/product/enduse/imports/c0000.html 24 http://www.census.gov/foreign-trade/statistics/highlights/top/top1112yr.html 25 http://www.census.gov/foreign-trade/statistics/graphs/PetroleumImports.html 26 http://orcosportsmans.com/Pages/NewContract.htm 27 http://blog.heritage.org/2012/01/20/1000-days-without-a-budget-facts-on-the-senates-failure/

|